Medical Debt May Be Removed from Credit Reports

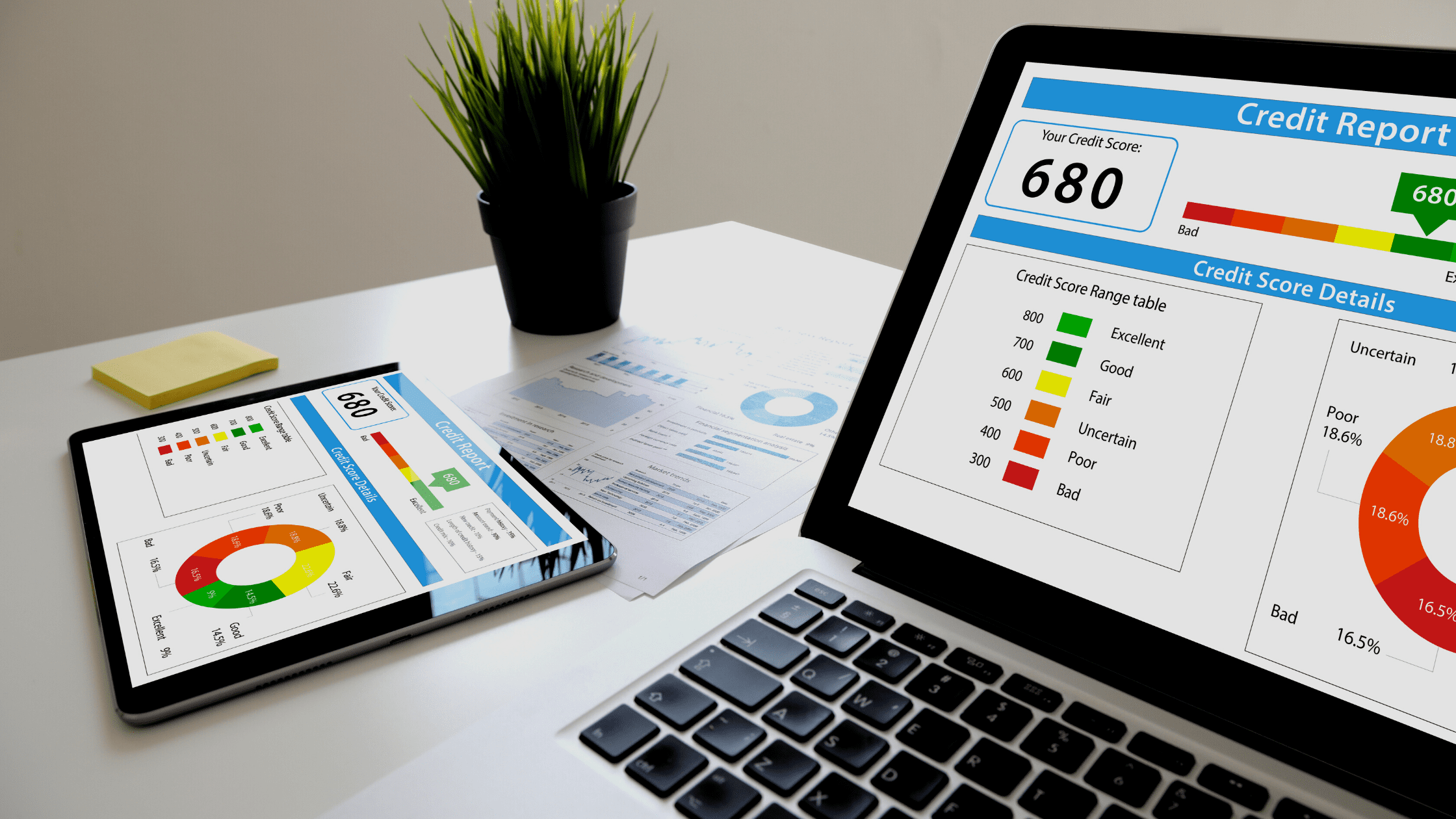

Medical debt collection is a huge burden for many Americans. Medical emergencies and unexpected diagnoses often result in giant bills that can easily overwhelm people who otherwise never miss a debt payment. Unpaid bills appear on credit reports, lowering credit scores and making it difficult for consumers to access affordable mortgages, car loans, and other financial services.

According to three major credit reporting bureaus – EquiFax, Experian, and TransUnion – medical debt that was sent to a collections agency and eventually paid off will be removed from consumer’s credit reports beginning July 1, 2022. Prior to this change, these debts could remain on a consumer’s credit report for up to seven years, even if they were repaid. To give consumers more time to address the medical bill, any unpaid medical bill won’t appear on their credit report for one year, up from the current six months. The credit bureaus also announced that medical debt collection under $500 won’t appear on consumer credit reports starting in the first half of 2023.

“This is an important step to support consumers in the wake of the Covid-19 pandemic,” the companies said in a joint statement. “These changes reflect our ongoing commitment to helping facilitate access to fair and affordable credit for all consumers.”